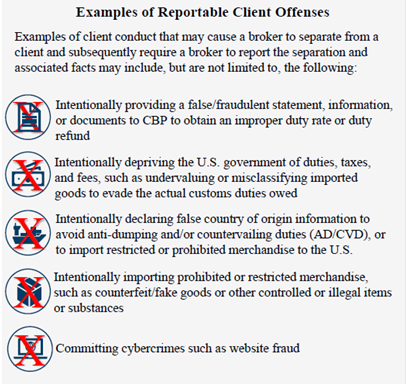

CBP released the attached fact sheet on 19 C.F.R. §111.32 which, pursuant to the recently amended broker regulations, requires customs brokers to notify CBP when the broker “separates from or cancels representation of a client” that is attempting to intentionally defraud the U.S. Government or commit any criminal act against the U.S Government through the broker. The attached fact sheet provides (1) specific examples of reportable offenses, (2) directions on how to report them and (3) the information that must be reported to CBP. For ease of review, we have excerpted below the examples given by CBP.

We also note the following key points associated with this new requirement:

- CBP distinguishes these scenarios from situations where the broker provides its client with a corrective action plan that is followed and the broker determines that it is unnecessary to separate from the client;

- CBP indicates that it will protect the broker’s identity to the “extent possible”; and

- The reporting requirement is not limited to customs offenses; the regulation covers any fraud or criminal act against the U.S Government (not just CBP).

Significantly, whereas the broker cannot file any information with the U.S. Government which it knows to be false or misleading, the broker’s decision to separate from a client for business reasons not relating to a fraud on the U.S. Government do not have to be reported to CBP under the regulation.

Please feel free to contact any of our attorneys with questions or concerns.