By Erik Smithweiss and Sarah Raymond

On February 14, 2025, the Trump administration released the list of “derivative” products that will be subject to the 25% steel and aluminum tariffs under Section 232. The notices are scheduled to be published in the Federal Register notice on Tuesday, February 18, 2025. The specific HTS subheadings are available here (steel) and here (aluminum).

The steel and aluminum derivative tariffs will impact a broad range of downstream products, including the following:

– Nearly all of Chapter 73, including gazebos, canopies and the like

– Certain household articles of aluminum

– Steel and aluminum furniture (9403.20.00)

– Parts of lighting (9405.99.40)

– Stoves, ranges, barbecues, etc. and their parts (7321)

– Steel and aluminum cookware

– Aluminum doors, windows, and their frames (7610.10.00)

– Parts for electric water heaters, hair dryers, and similar household appliances (8516.90.8050)

– Some exercise and sporting equipment (9506, 9507)

Tariffs on derivatives will not take effect until the Secretary of Commerce certifies that adequate systems are in place to collect tariff revenues for these products. There is no target date set for the Secretary’s certification. Please see our prior alert for details on the implementation of the updated steel and aluminum tariffs.

The Secretary of Commerce is required to establish a process for identifying additional derivative products that could become subject to the 25% tariffs, including products requested by domestic producers.

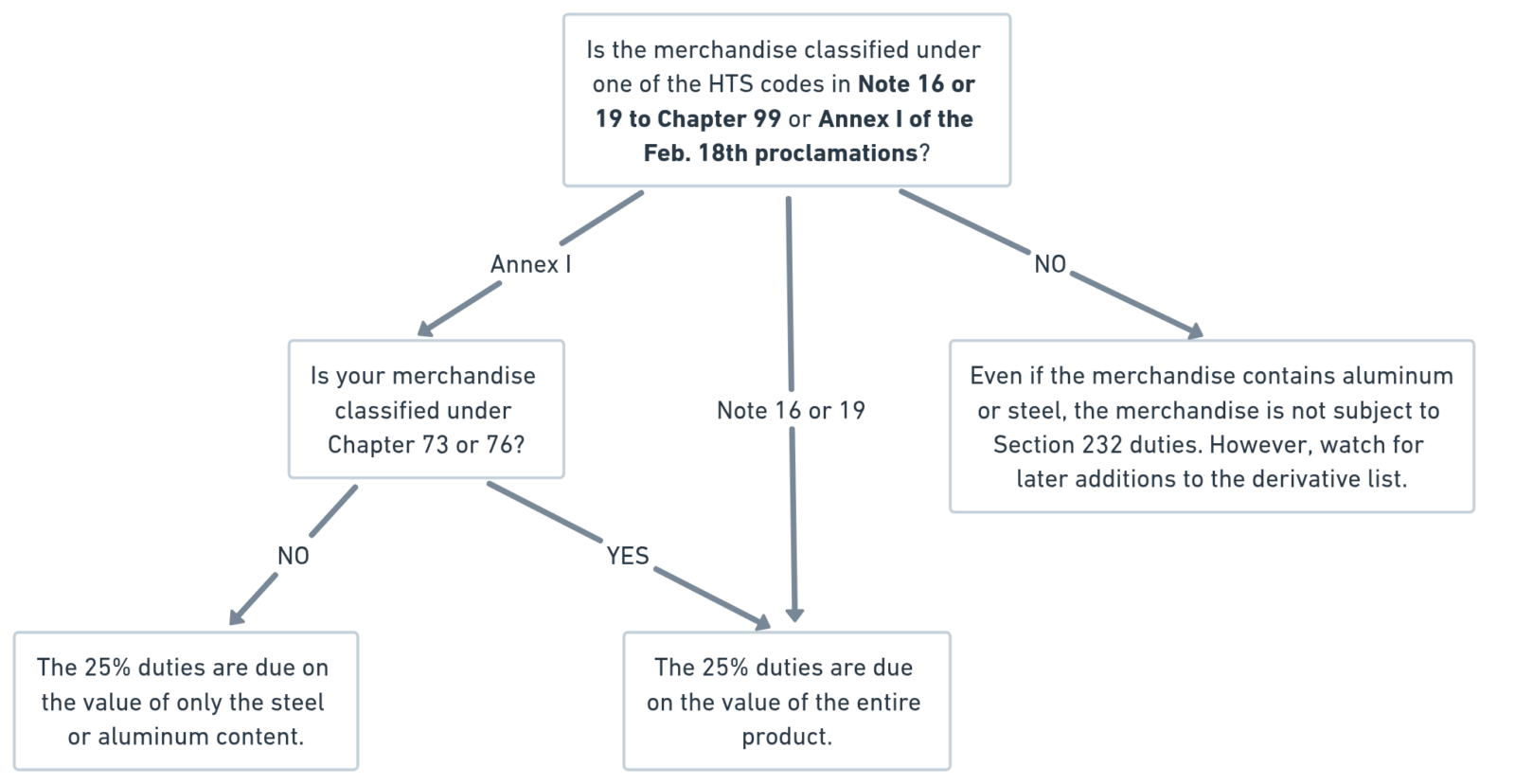

For derivatives classified in Chapter 73 or 76, the 25% tariff will apply to the full product value. For derivatives classified outside of Chapter 73 or 76, the 25% tariff will only apply to the value of the steel or aluminum content, not the entire product. The notices do not specify any specific method for calculating the value of the steel or aluminum content.

The tariffs on derivative steel and aluminum only apply to products classified in a listed subheading. Products containing steel and aluminum, but not classified in a listed subheading, will not be subject to the 25% tariff on their steel or aluminum content.

The 25% steel and aluminum tariffs are cumulative with any other applicable tariffs. For example, steel cookware classified under HTSUS subheading 7323.93.0045 is included in Annex I of the steel proclamation and will be subject to the following tariffs on the entire product value.

• The regular MFN duty rate of 2%,

• 25% Section 232 duties, and

• 10% additional duties on Chinese goods (if made in China)

The following flow chart provides guidance on evaluating the application of the steel and aluminum tariffs*:

*This flow chart was updated on February 25, 2025.

Please contact one of our attorneys if you have questions regarding the imposition of the steel and aluminum tariffs, and potential strategies for mitigating the tariffs through tariff engineering or implementation of alternative methods of customs valuation.