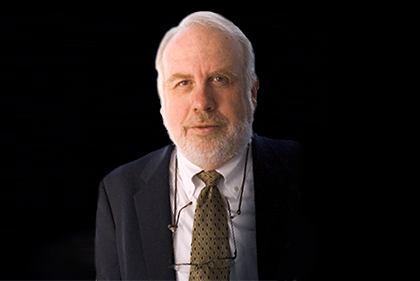

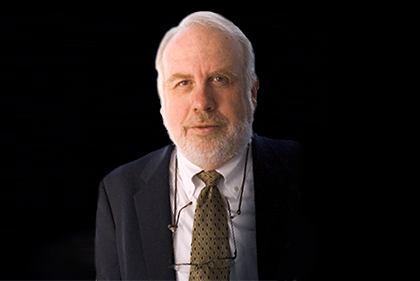

David J. Lyon practices in the area of business organizations and transactions with a heavy emphasis on international transactions and international tax planning. Part of his practice also includes estate and income tax planning for the owners of the businesses he represents. David’s experience includes business and tax planning for private and public companies; including representing private and public companies on both the buying and selling side of sale or acquisition transactions, sophisticated joint venture planning, and the creation of structures for doing business outside the United States. David graduated from Brigham Young University in 1972 with a degree in economics and obtained his law degree from Cornell University Law School in 1975. He continued to receive a Masters of Law (Taxation) from New York University in 1979. He is a native of Nevada (born 1948), one of the few people of his age who was actually born in the State of Nevada.

Mr. Lyon is the author of “Limits on Limits: Interaction of the Tax Benefit Rule With Net Operating Losses in California (and Elsewhere),” State Tax Notes at 385 (1999), “Continuing Expansion of the Limits on Interest Deductions Can be Avoided,” 37 Taxation for Accountants 76 (1986) and “Reorganization and Sale of a Business,” Ohio State Taxation (1985).

New York University LL.M. (1979)

Cornell University Law School J.D. (1975)

Brigham Young University B.A. magna cum laude (1972)

US Tax Court (1987)

American Bar Association

Taxation

Nevada State Bar Membership

Ohio State Bar Membership

Copyright © 2025 Grunfeld, Desiderio, Lebowitz, Silverman & Klestadt LLP. All Rights Reserved.